Trust is the cornerstone of any economic device, underpinning transactions, contracts, and interactions between events. Traditionally, belief has been centralized, and vested in economic establishments, governments, and intermediaries to facilitate transactions and implement agreements. However, the emergence of blockchain technology has ushered in a new era, one that is decentralized, transparent, and immutable, empowering users to securely manage their digital assets through platforms like immediatehelix.com, paving the way for a more accessible and inclusive financial landscape. In this newsletter, we discover the evolution of monetary structures and the possibilities for buyers in decentralized finance (DeFi).

The Centralized Paradigm:

For centuries, centralized economic systems have dominated the global economic system, relying on trusted intermediaries, including banks, governments, and regulatory bodies, to facilitate transactions, preserve facts, and put into effect contracts. While those systems have provided stability and performance, they have also been plagued with problems such as opacity, censorship, and counterparty hazards.

Centralized financial establishments control access to monetary services, impose prices, and exercise authority over price ranges, leading to a loss of economic inclusion and dependence on 0.33 parties for belief and protection. Moreover, centralized structures are liable to hacking, fraud, and manipulation, as evidenced by numerous excessive-profile breaches and scandals inside the banking sector.

The Rise of Blockchain Technology:

Blockchain technology, brought about by Satoshi Nakamoto with the creation of Bitcoin in 2009, offered a progressive solution to the problem of financial structures. By decentralizing through the dispensed ledger era and cryptographic consensus mechanisms, blockchain allows peer-to-peer transactions without the need for intermediaries.

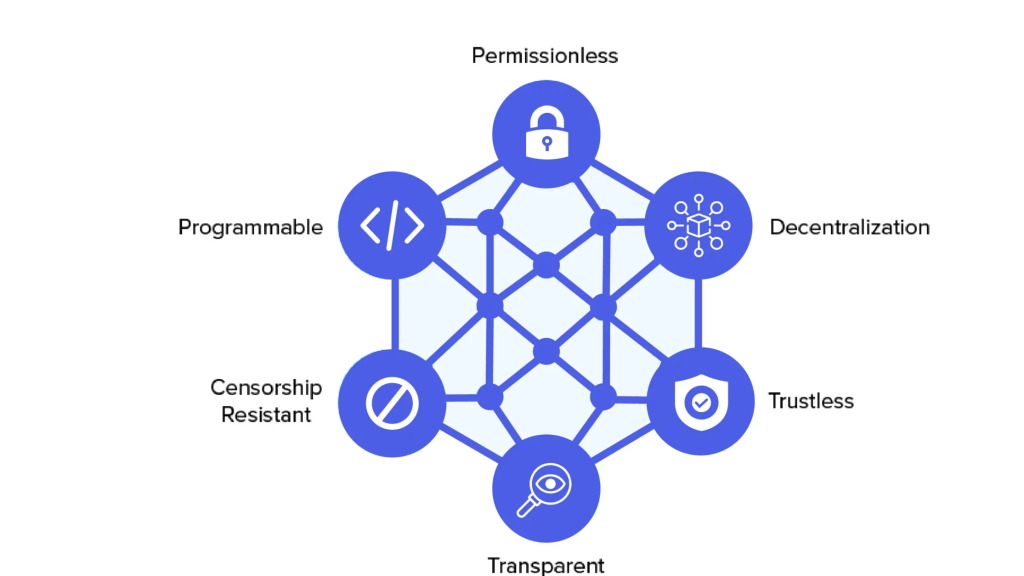

Blockchain networks record transactions transparently and immutably on a shared ledger, putting off the risk of fraud, censorship, and manipulation. Participants within the network together validate transactions through consensus algorithms, ensuring consideration and security without relying on a centralized government.

Decentralized Finance (DeFi) Revolution:

Decentralized Finance, or DeFi, represents the subsequent evolution of blockchain generation, aiming to democratize access to financial offerings, take away intermediaries, and empower customers to control their assets and take part in worldwide markets. Built on public blockchain platforms, including Ethereum, DeFi protocols allow an extensive range of monetary activities, including lending, borrowing, buying and selling, and asset control, without the need for trusted third parties.

Investing in DeFi offers several benefits over conventional economic structures, including:

Accessibility: DeFi protocols are open and permissionless, permitting absolutely everyone with a web connection to get the right of entry to monetary offerings without geographic or bureaucratic limitations.

Transparency: DeFi transactions are transparent and auditable at the blockchain, imparting customers with real-time visibility into asset actions, balances, and transaction history.

Security: DeFi platforms leverage cryptographic standards and clever contracts to ensure safety and put in force agreements without reliance on centralized authorities.

Interoperability: DeFi protocols are interoperable, enabling seamless integration and composability of economic services, products, and applications across different systems and ecosystems.

Opportunities for investors:

Investing in decentralized financial structures affords compelling opportunities for traders in search of exposure to the burgeoning DeFi ecosystem. Some of the key funding possibilities in DeFi encompass:

Yield Farming: Yield farming includes leveraging DeFi protocols to earn passive profits by presenting liquidity, staking belongings, or collaborating in liquidity mining applications. Yield farmers can earn rewards in the form of interest, trading prices, or governance tokens that may be appreciated over the years.

Decentralized Exchanges (DEXs): Decentralized exchanges facilitate peer-to-peer trading of virtual property without the need for intermediaries. Investing in DEXs lets users change cryptocurrencies securely and successfully while retaining control of their funds.

Lending and Borrowing: DeFi lending platforms permit customers to lend out their crypto assets and earn a hobby or borrow assets against collateral without the need for a traditional bank. Investors can earn passive earnings by imparting liquidity to lending swimming pools or get access to liquidity by borrowing in opposition to their holdings.

Governance Tokens: Many DeFi protocols use governance tokens to incentivize participation and network governance. Investing in governance tokens lets holders participate in protocol governance, impact selection-making, and doubtlessly earn rewards through vote-casting and staking mechanisms.

Conclusion:

The evolution of acceptance as true in monetary systems, from centralized intermediaries to decentralized protocols, has opened up new opportunities for traders looking to take part in the digital economic system. Decentralized Finance (DeFi) represents a paradigm shift in how financial offerings are accessed, introduced, and ruled, imparting more accessibility, transparency, and security than conventional systems.

Investing in decentralized monetary structures lets traders harness the energy of blockchain technology to earn passive income, access international markets, and participate in revolutionary monetary services and products. While DeFi affords opportunities for extensive returns, it’s far more critical for traders to conduct thorough research, understand the risks involved, and adhere to pleasant practices for safety and hazard control.

As the DeFi atmosphere continues to adapt and mature, buyers have the opportunity to form the future of finance by supporting decentralized protocols, contributing to community governance, and driving innovation within the digital economic system. By embracing the ideas of decentralization, transparency, and self-sovereignty, traders can participate in the evolution of, agree with, and build a more inclusive and equitable economic machine for the future.